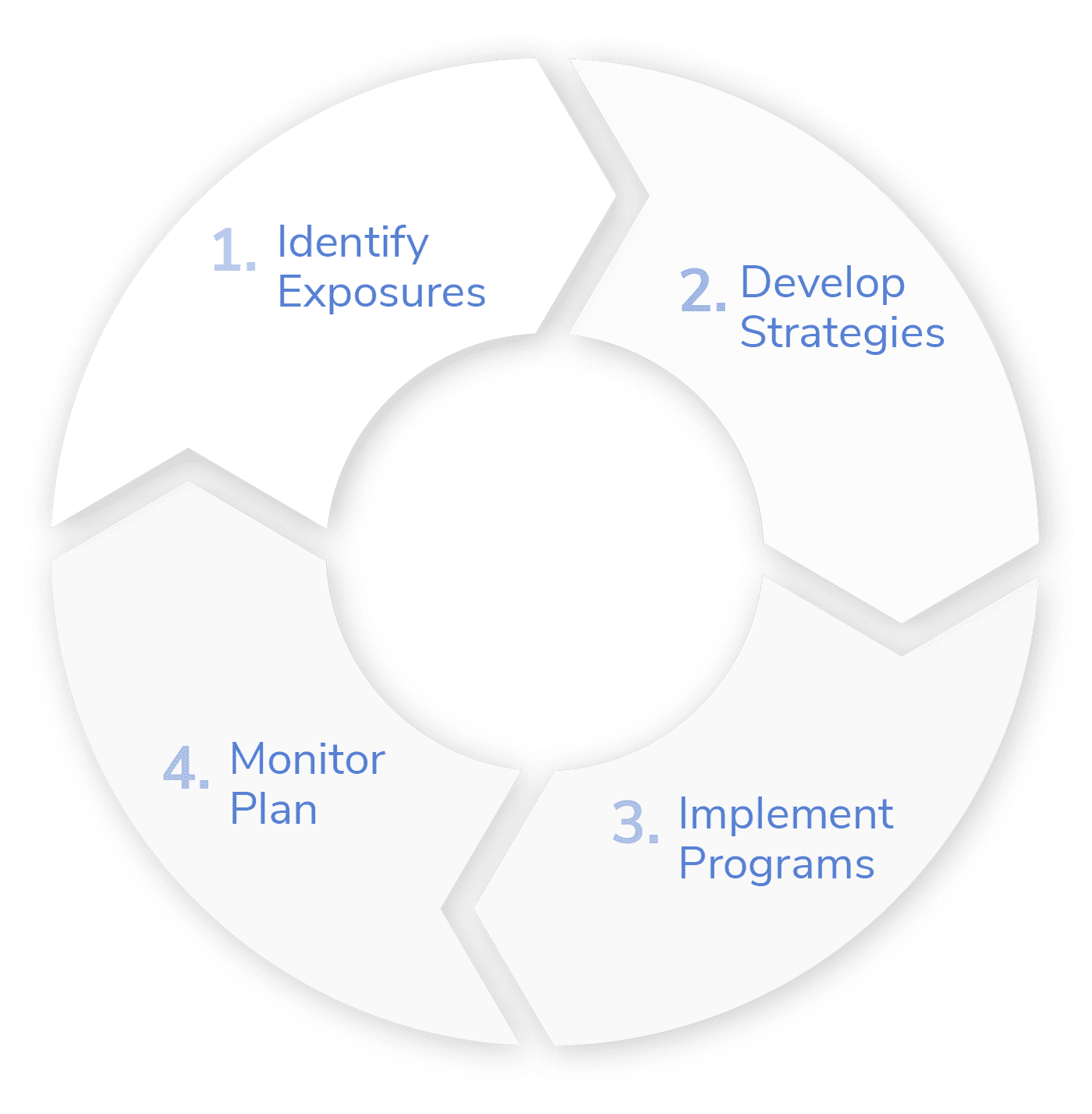

A proprietary 4-step process.

Beyond Insurance® is simple yet revolutionary.

With Beyond Insurance® we identify, understand, implement and monitor the Risk Management strategies for you and your business.

The Beyond Insurance® Process is simple yet revolutionary. It begins with a curiosity and desire to understand the inner workings of a business. If one does not understand a business and its issues, it is not possible to adequately perform exposure identification. The Reagan Companies agrees that the design and procurement of insurance is essential. However, unlike most agents, brokers and carriers, The Reagan Companies does not see insurance as the cornerstone of deep, long lasting and mutually profitable relationships.

The Beyond Insurance® Process utilizes a variety of techniques to identify, measure and reduce risk while enhancing an organization’s performance through non-insurance solutions. Each decision about how to manage risk is examined in light of its impact on an organization’s bottom line.

The Beyond Insurance® Process

Simple yet revolutionary.

Why Insurance Carriers Love the Beyond Insurance® Process

Insurance carriers love The Beyond Insurance ® Process for a number of reasons including enhanced new business “success ratio,” retention, and outstanding loss ratios. The following represent a few quotations from Regional and Branch Managers of national insurance companies:

Request a Beyond Insurance® Interview

The Reagan Companies is extremely selective in choosing organizations for the Beyond Insurance® process. We want to make sure it’s the right fit. Complete the form below and one of our risk advisors will reach out to you to schedule an interview.